It’s that time of year many are familiar with: tax season. Rounding up and making sense of confusing tax forms is stressful, and for those barely making ends meet, $200 to $300 for a tax preparer or tax software access is often a hefty and unaffordable cost.

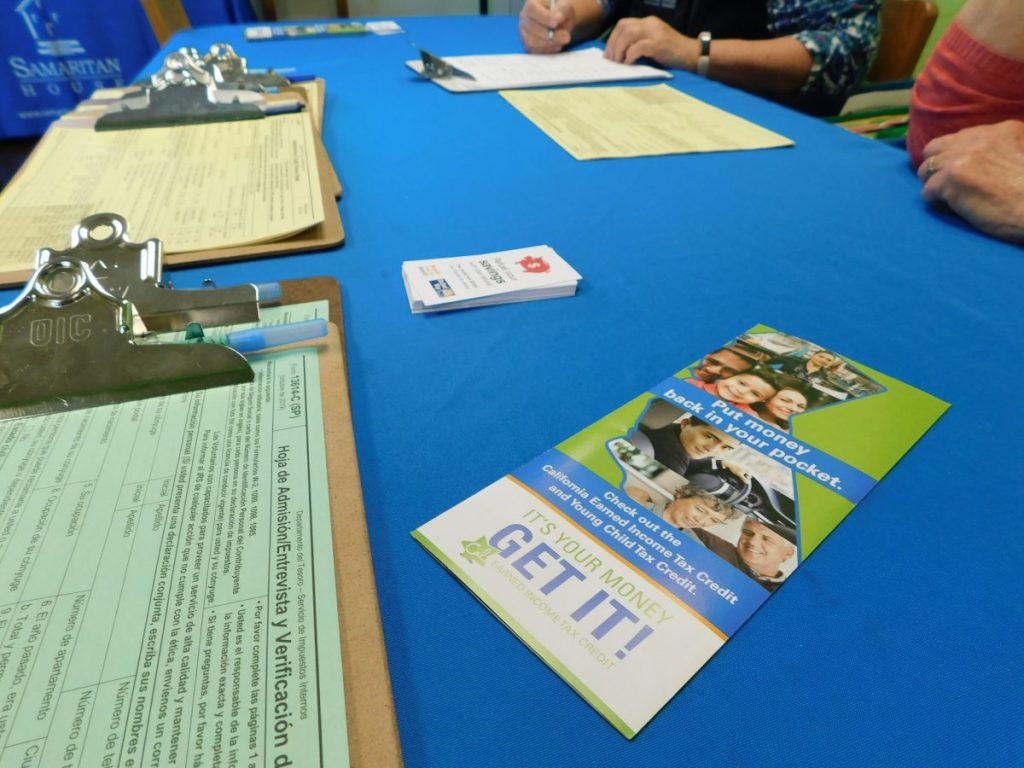

Samaritan House offers free tax preparation and bolsters awareness of the Earned Income Tax Credit (EITC), so that Bay Area residents in need can reach a place of financial stability. According to United Way Bay Area, the EITC is a “refundable tax credit that can be up to $6,431 for a family with three qualifying children”. During the 2019 tax season, we generated $486,379 in refunds!

Imagine if a client is making $20,000, but gets $6,000 back. We do everything we can, within the rules, to make sure our clients get their credit earned.

Rhonda Kaufman, Financial Empowerment Manager